Introduction

In 2025, personal finance apps are smarter, more secure, and deeply connected to our daily lives. From AI-powered budgeting to crypto investments, these apps redefine how we manage money. Here are five standout finance apps of 2025.

1. FinTrack AI – Your Smart Budget Assistant

Category: Budgeting & Expense Tracking

FinTrack AI simplifies money management with:

- AI-generated monthly budgets based on spending habits

- Real-time expense categorization and alerts

- Smart savings recommendations

- Multi-bank account integration

- Offline tracking for cash spending

2. InvestWise+ – Smarter Investment Companion

Category: Investment Management

InvestWise+ enhances your investment journey with:

- AI-based stock and crypto insights

- Personalized portfolio diversification tips

- Real-time market analysis and alerts

- Auto-rebalancing for risk management

- Educational resources for new investors

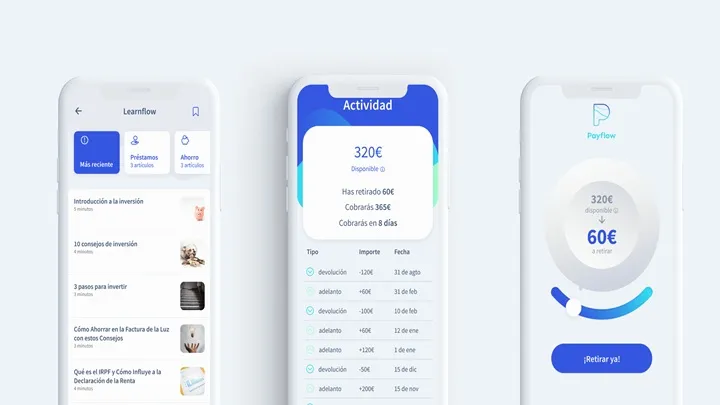

3. PayFlow 360 – Seamless Payment Hub

Category: Payments & Transfers

PayFlow 360 streamlines payments with:

- One-tap bill payments and reminders

- Cross-border transfers with low fees

- Real-time transaction tracking

- QR and NFC payments everywhere

- Family and group expense splitting

4. SaveSmart – Automated Savings App

Category: Savings & Goals

SaveSmart helps you reach financial goals with:

- AI-powered micro-savings from daily purchases

- Automated transfers to savings accounts

- Customizable financial goals (vacations, cars, homes)

- Rewards for achieving milestones

- Secure savings vault with interest growth

5. CreditGuard+ – Your Credit Health Manager

Category: Credit & Debt Management

CreditGuard+ ensures healthier credit with:

- Real-time credit score monitoring

- Personalized debt repayment plans

- AI tips for improving credit health

- Fraud and identity theft alerts

- Credit-building rewards system

Conclusion

The Top 5 Finance Apps of 2025—FinTrack AI, InvestWise+, PayFlow 360, SaveSmart, and CreditGuard+—are transforming how people handle money. With AI, automation, and real-time insights, these apps ensure smarter, safer, and more efficient financial management.